oregon tax payment deadline

Mar 31 Tax Bills Due. Below are forms for prior Tax Years starting with 2020.

Where S My Kentucky State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State

Tax payments delivered US.

. To receive a discount and avoid interest charges tax payments MUST be made timelyDue dates are November 15 2021 February 15 2022 and May 16 2022. You can make your quarterly tax payments based on the 75000 and you wont be penalized for it. Oregon tax extensions are automatic with a Federal Extension if you dont owe taxes.

Will filing my Amended Return be processed faster when filed electronically. 25000 base value exemption. Oregon allows for a six-month extension to file your tax return but it doesnt extend your time to pay.

For more information please visit our. Apr 01 PP Returns Due Inventory. Payment of any estimated tax due should be sent in by the original due date of the return to avoid a late payment penalty.

Just make sure its done by the deadline to avoid penalties and fees. These back taxes forms can not longer be e-Filed. For 2019 state taxes the state has extended the filing and payment deadline.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Learn about e-filing or view our list of approved tax preparation software to see if you qualify for a free e-filing option. If you expect to owe taxes file OK Form 504-I by the April deadline and include a tax payment.

Postmarked transmitted by private express carrier or paid online via the Douglas County website on or before a due date will be considered timely. Visit our forms page search for individual and select the appropriate return and instructions. For information about ACH Credit please refer to TAXs Electronic Payment Guide.

But you will need to pay tax for the extra 25000 as a lump sum on April 15. If they do not file a tax return within three years the money becomes the property of the US. E-file through a third party.

If any active lawsuit exists for a previous year attorney fees are added to the 2021 tax bill on February 1 2022 MARCH 31 2022-Last day to pay 2021 business personal property taxes without accruing attorney fees. In cases where a federal income tax return was not filed the law provides most taxpayers with a three-year window of opportunity to claim a tax refund. Nov 01 Tax Bills Issued Inventory exempt.

Mail the return to the address shown on the instructions. You can pay in several ways. False or fraudulent filing or tax evasion involves willfully filing false tax information failing to file or attempting to evade taxes.

Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs. But not to worry you can check the status of your refund. Although not required by state law a courtesy copy of the extension by the due date of the.

Willfully attempted to evade tax. 25 penalty for late filing. For 2016 tax returns the window closes July 15 2020 for most taxpayers.

If you file or pay after the May 1 deadline you will also owe penalty 100 of the tax due plus 100 and interest. If youre been missing payment deadlines its surprisingly complicated to figure out how much penalty you owe. Check to see if you can use a free tax preparation service.

Dont worry we can help. Oregon State Income Tax Forms for Tax Year 2021 Jan. If you owe taxes file OR Form 40-V with the Original return box checked by the April deadline and include your tax payment.

JANUARY 31 2022- Last day to pay 2021 tax bill without penalty and interest. Filing_upsell_block Finding out how much penalty you owe. Failed to file a return.

Oregon Income Tax Forms. You can amend Tax Year 2019 Tax Year 2020 and Tax Year 2021 Forms 1040 and 1040-SR returns electronically at this time. The hardest part of getting a tax refund payment is waiting for it to arrive.

If a due date falls on a weekend or legal holiday the deadline is pushed to the next business day. Not only will there be no time limit on IRS action against tax fraud or tax evasion but there may be increased interest fees and penalties. As with the federal deadline extension Oregon wont charge interest or apply any penalties on unpaid balances between April 15 and July 15 2020.

This includes payment of your 2021 tax liability. The 2021 tax deadline to file City of Oregon returns is April 18 2022. Dec 31 Tax Bills Due.

Tax Bills Due Deadline for 2 discount. Oregon residents now have until July 15 2020 to file their state returns and pay any state tax they owe. For more information see the instructions for Form 200.

The installment payments are typically due on April 15 June 15 and September 15 of the current year and then January 15 of the following year. You can skip the final payment if you will file your return and pay all the tax due by February 1. NOVEMBER 30 2021- 1st HALF-PAYMENT due.

Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. Taxpayers who are under the age of 18 are exempt from the tax. Details on how to only prepare and print a Oregon 2021 Tax Return.

Currently the normal processing time of up to 16 weeks also applies to electronically filed Amended Returns. 89 hours of instruction in Oregon. State tax returns and payment are due nine months after the death of the estate owner.

The state only grants extensions to pay under special circumstances as identified by OAR 150-118-0150. Feb 28 Tax Bills Due Deadline for 1 discount. Nov 30 Tax Bills Due Deadline for 4 discount.

The practical effect of the tax is to tax income of certain City residents within a certain income range and is therefore not a poll or head tax On June 8 2016 the Oregon Court of Appeals affirmed the decision of the Multnomah County Circuit Court.

Live In One These States You Have A Deadline Approaching Fill Out The Fafsa Form Now Fafsa Gov Sparkeduniversity Fafsa Fafsa Fafsa Deadline College Advice

Tax Day 2022 Why This Year Will Be On April 18th Marca

![]()

Accounts House Google Certified Accountant How To Plan Accounting

Yamhill County Oregon Yamhill County Mcminnville

Get Our Printable Eviction Notice Template Illinois Eviction Notice Being A Landlord Templates

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

The Ftb Reminded Taxpayers That Thursday October 15 Is The Deadline For Filing 2019 State Personal Income T California Summer School Programs Penitentiary

Accounts House Google Certified Accountant How To Plan Accounting

Oregon Man Finds Year Old 1 Million Lotto Ticket Eight Days Before Deadline Bilet Fakty Mir

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Ifta Fuel Tax Returns Global Multiservices Tax Return Global Renew

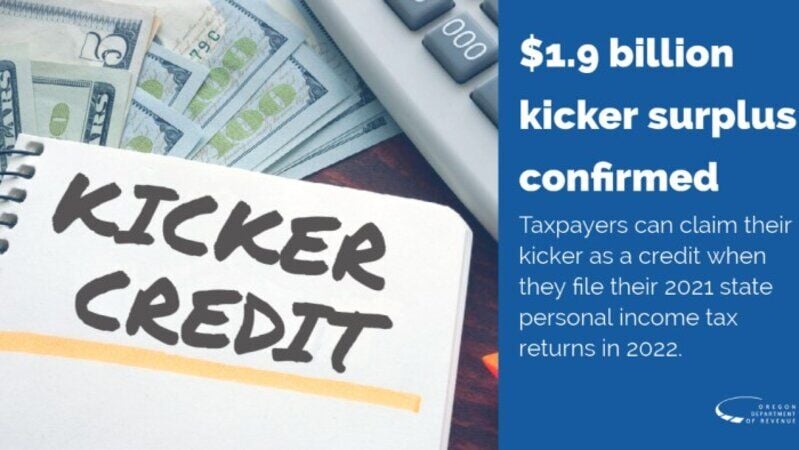

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Irp Plates Renewal The Duty Of Every Motor Carrier Renew How To Plan Plates

Oregon Reminds That Tax Filing Deadline Is April 18 News Kdrv Com

Pamplin Media Group Oregon Feds Extend Tax Filing Deadline To May 17

The Greatest Homemade Doughnut Recipes You Ll Ever Find Huffpost Life Prepaid Debit Cards Irs Best Us Presidents

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free